Saifr, an AI-focused regulatory technology (RegTech) provider that assists financial institutions with creating, reviewing, and approving communications to help mitigate brand, regulatory, and reputational risk, today announced the addition of its risk interpretation and suggested language capabilities

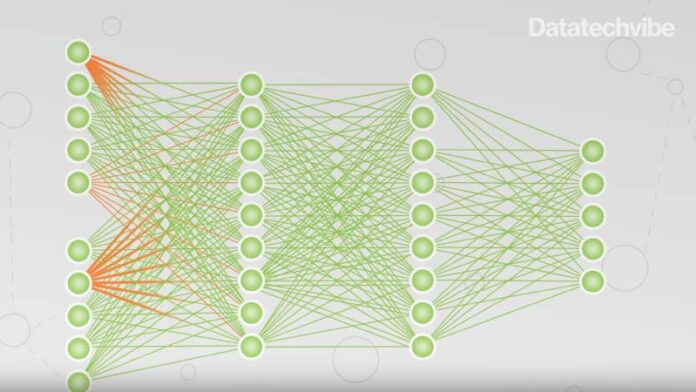

Saifr’s natural language processing (NLP) models “read” content and flag potential compliance risks in text and images. Risks are flagged as promissory, misleading, exaggerated, unwarranted, unfair, and balanced

The risk interpretation model then explains in detail why the text was flagged. The suggested language function provides alternative text that is more compliant. The content creator can accept the suggested text or create a viable alternative.

“We are taking RegTech AI one step further by implementing risk interpretation and suggested language models. Understanding the ‘why’ behind flagged text enables content creators to address risks early in the process seamlessly, and suggested language helps them submit cleaner copy for quick approvals,” said Vall Herard, Co-Founder and CEO of Saifr. “The technology in our compliance tools shows what can be possible when AI is harnessed purposefully.”

With Saifr, marketing teams can proactively make changes before a first compliance review, thus reducing the number of handoffs and accelerating time to market.

Recently, Saifr announced improved access to its robust analytics through SaifrScan Add-ins. Users can now access the AI compliance scans within their existing suite of business apps, such as Microsoft 365. The add-ins deliver the same scan speed and accuracy as when users work directly in the SaifrReview application.